|

Operating review

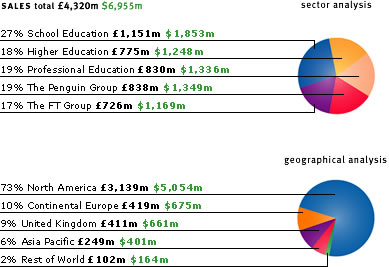

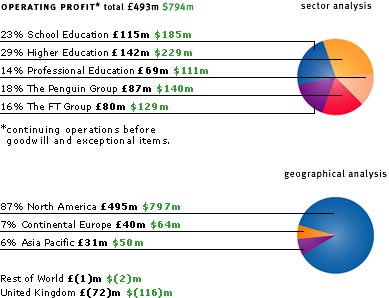

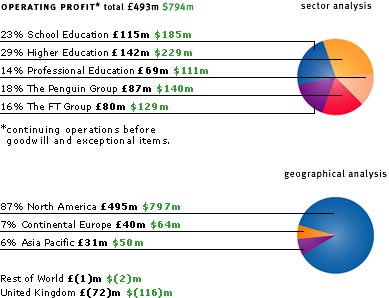

In 2002, sales increased by 6% to £4,320m and operating profit from continuing

operations improved by £67m to £493m, an increase of 18%. Adjusted earnings per

share grew to 30.3p, a headline increase of 42%. Operating free cash flow

improved by £69m to £305m. Average use of working capital improved by £53m in

our book publishing businesses, even as we increased investment in new authors,

titles and programmes.

On a statutory basis, Pearson reported a loss before tax for the year of £25m (a

£436m loss in 2001) and generated a loss per share of 13.9p (a loss per share of

53.2p in 2001). The loss includes a (non-cash) goodwill charge of £340m. Net

borrowings fell by £971m to end the year at £1,408m. The board is recommending a

5% increase in the dividend to 23.4p per share.

|

|